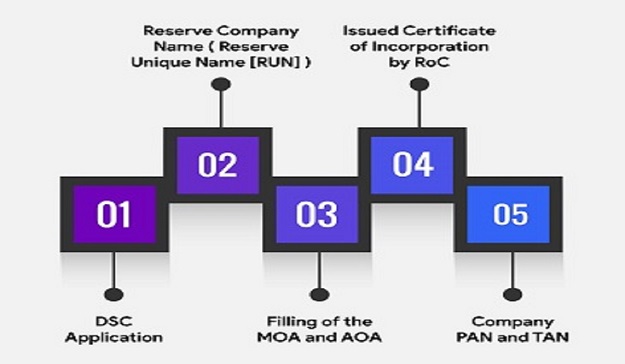

How To Register A Nidhi Company?

Registering a Nidhi Company is quick, easy, and can be done online with Legalguard.in in 3 simple steps.

Obtain digital signature certificate.

We draft and file the documents required for registration (MoA, AoA & Declarations).

We help you with the post-registration formalities and compliances.

Nidhi Company Registration

Nidhi Company is the easiest and affordable way to start a finance business in India. It requires only 7 people with basic documents to start the Nidhi Company. The minimum capital required for Nidhi Company registration is Rs. 5 lakh only.

Nidhi Company can do only the business of accepting deposit from and lending money to its members. It cannot deal with the public directly and can work only with its members. However, one can easily make members under Nidhi Company with few documents and easy process. Also, Nidhi Company registration is the only form of the company available to start a finance company in India without RBI approval.

A Nidhi may open up to three branches within the district, only if it has earned net profits after tax continuously during the three financial years. If a Nidhi proposes to open more than three branches within the district or any branch outside the district, it shall obtain the prior permission of the Regional Director. A Nidhi can not open branches or collection centres or offices or deposit centres, or by whatever name called outside the State where its registered office is situated.

What is Nidhi Company - Key features

To understand the meaning of Nidhi Company in the best possible way is to understand through its features. Nidhi Company is basically a finance company which can accept deposit from members and lend the same money to its members. Nidhi Company mainly earns through interest on loans and its main expenditure is to pay interest on deposits (FD, RD and savings).

Loan & Deposit under Nidhi Company

Nidhi Company is becoming so much popular among the businessman who wants to start the finance or loan business. The main reason behind this fact is the advantage of Nidhi Company to accept deposit from the public and to lend money to the public (members) without any RBI approval. Let us understand brief about the loan and deposit under Nidhi Company.

Compliances after Nidhi Company Registration

There are basically four pillars to the compliances of Nidhi Company in India and all the reporting revolves around it. Here are three pillars to the Nidhi Company compliances explained briefly.

NDH - 3 Filing

NDH - 3 is a half-yearly return filed in order to check whether the Nidhi company is working as per the rules or not. This return is to be filed by 30th October and 30th April each year.

NDH - 1 Filing

Every Nidhi shall within ninety days from the close of the first financial year after its incorporation and where applicable, the second financial year, file a return of statutory compliances in Form NDH-1.

NDH - 2 Filing

If a Nidhi is not complying with clauses (a) or (d) of sub-rule (1) above, it shall within thirty days from the close of the first financial year, apply to the Regional Director in Form NDH-2.

NDH - 4 Filing

A Nidhi incorporated under the Act on or after the commencement of the Nidhi (Amendment) Rules, 2019 shall file Form NDH-4 within sixty days from the date of expiry of:-

(a) one year from the date of its incorporation or

(b) the period up to which extension of time has been granted by the Regional Director under sub-rule (3) of rule 5.

RBI requirement vs. Nidhi Company rules, 2014

Do you know that a Nidhi Company does not require any RBI approval to get registered in India? Yes, it is true. You can register a Nidhi Company in India without any RBI approval. There is no RBI requirement for Nidhi Company. Actually, Nidhi Company has been exempted by the RBI from its core provisions and hence, it does not require an RBI license, no 2 crore capital requirement and many more. Hence, Nidhi Company is said to be one of the best ways to start a finance business in India.

As said, the RBI does not govern the Nidhi Companies rather it is being governed by the central government through Nidhi rules, 2014. Nidhi rules laid down the complete set of code or rules according to which every Nidhi Company should work. Nidhi Company does not require any other approval from any state authority to work as it is being already permitted by Central Government in terms of Nidhi Rules, 2014. Nidhi Company rules, 2014 contain almost 24 rules describing the loan, deposits, Compliances, branches etc about the Nidhi Company.

Hence, if you are looking to start a Nidhi Company in India, then it is recommended to read all the Nidhi rules, 2014 properly @ http://ebook.mca.gov.in/Default.aspx?page=rules

Checklist For A Nidhi Company

As defined under the Companies Act 2013, we have to ensure the requirements of the following checklist

Three Directors

A Nidhi Company must have at least three directors and at most, there can be 15 directors. Among all the directors in the company, at least one must be a resident of India.

Seven Shareholders

There should be a minimum of 7 shareholders at the time of registration. It means that documents of 7 persons are required to register a Nidhi Company.

Unique Name

The name of your business must be unique. The suggested name should not match with any existing companies or trademarks in India.

Minimum Capital Contribution

Minimum capital required for registration of Nidhi Company is 5 Lakh rupees.

Registered Office

The registered office of a Nidhi company does not have to be a commercial space. Even a rented home can be the registered office.

How to Register Nidhi Company - A Detailed Registration Process

Nidhi Company Registration is a very easy process. The complete process is online and can be completed from the comfort of your home. The Ministry of Corporate Affairs governs the Nidhi company registration process with rules and regulations framed following the law.

Search the Name before Registration

One of the primary steps in Company Registration is to ensure that the company name has not already been taken by another legal entity. We can run a company name search to check the availability of the particular name in India against the MCA and trademark database.

The Company name can be checked in MCA Database

@ http://www.mca.gov.in/mcafoportal/showCheckCompanyName.do

and in Trademarks Database

@ https://ipindiaonline.gov.in/tmrpublicsearch/frmmain.aspx

We recommend the businesses to come up with three to four alternative names. The Ministry of Corporate Affairs will be the final authority to approve the name based on the availability rules and regulations.

If you are disappointed that a preferred name is taken, do remember that the name of your company doesn't have to be your brand name.

Documents required for Nidhi Company Registration

Nidhi company registration cannot be done without proper identity and address proof. These documents will be needed for all the directors and the shareholders of the company to be incorporated. Listed below are the documents that are accepted by MCA for the Nidhi company registration process.

Identity And Address Proof

- Scanned copy of PAN Card. Foreign nationals must provide a valid passport.

- Scanned copy of Voter’s ID/Passport/Driver’s License/Adhar

- Scanned copy of the latest bank statement/telephone or mobile bill/electricity or gas bill

- Latest Passport size Color photograph of all the promoters (Shareholders and Directors)

For foreign nationals, an apostilled or notarized copy of the passport has to be submitted mandatorily. All documents submitted should be valid. The residence proof documents like the bank statement or the electricity bill must be less than 2 months old.

Registered Office Proof

- Latest & Clear Telephone Bill/Electricity Bill/ /Water/Gas Bill of the registered office address

- No Objection Certificate from the owner(s) of the premises of the registered office.

Note: Your registered office need not be a commercial space; it can be your residence too.

What you get after Nidhi Company registration

Legalguard.in Company Registration package includes:

Why Legalguard.in

Access To Experts

We provide access to reliable professionals and coordinate with them to fulfil all your legal requirements. You can also track the progress on our online platform, at all times.

Realistic Expectations

By handling all the paperwork, we ensure a seamless interactive process with the government. We provide clarity on the incorporation process to set realistic expectations.

150-Strong Team

With a team of over 150 experienced business advisors and legal professionals, you are just a phone call away from the best in legal services.

Frequently Asked Questions

What is the RBI requirement for Nidhi Company?

Nidhi Company is one of the forms of Non-Banking Financial Company (NBFC) which do NOT require RBI approval. The Nidhi Company has been exempted by the Reserve Bank of India (RBI) from taking the registration. Further, there is no required for keeping the minimum capital at Rs.2 crore to start the Nidhi Company in India.

What do you mean by Nidhi Company rules?

Nidhi Company is not governed by the RBI but by the central government and hence the central government has introduced the Nidhi Company rules 2014 in order to better govern the company in a more transparent manner.

Can a Nidhi Company do microfinance business?

No, Nidhi Company is not allowed to do microfinance business in India. These are because microfinance is a completely different set of business for an NBFC and require more capital to do the same. Hence, Nidhi Company cannot engage itself in the microfinance business. Further, since Nidhi Company raises fund from deposits and hence if it passes the same to the member without any security, then there will be great chances of customer default which will ultimately result in the bankruptcy of the Nidhi Company.

How many branches a Nidhi Company can open?

A Nidhi may open branches, only if it has earned net profits after tax continuously during the preceding three financial years. A Nidhi may open up to three branches within the district. If a Nidhi proposes to open more than three branches within the district or any branch outside the district, it shall obtain the prior permission of the Regional Director. Also, a Nidhi Company cannot open a branch outside the state.

Is it mandatory to have Nidhi Company software installed?

No, it is not mandatory to have Nidhi Company software to run your finance business. However, if you want to run the business properly, then you shall require the Nidhi Company software. Nidhi Company main business is to accept deposits and lend money to its members and so the calculation of interest etc requires typical calculations and hence, it is advised to use Nidhi Company software for proper and efficient working.

What do you mean by Mutual benefit Company and how it is different from Nidhi Company?

Mutual Benefit Company is nothing but a Nidhi Company. Mutual benefit is the previous name of the Nidhi Company. After 2013, it was made mandatory to use the name of Nidhi Limited instead of Mutual benefit for registration of Nidhi Company in India.

What is the maximum amount of deposits a Nidhi Company can take?

A Nidhi Company is allowed to take a maximum of 20 times the net owned fund. Net owned fund means the total fund invested by the owner less any accumulated loss. For example, if you have invested Rs.1 crore, then you are entitled to raise funds up to Rs.20 Crore.

What if a Nidhi Company is unable number of its members to 200 within 1 year of incorporation?

In such a case, Nidhi Company can apply to RD for an extension of time to increase the number of its members up to 1 more year.

What is Un-encumbered Term Deposits?

Every Nidhi shall invest and continue to keep invested, in unencumbered term deposits with a scheduled commercial bank (other than a co-operative bank or a regional rural bank), or post office deposits in its own name an amount which shall not be less than ten per cent. of the deposits outstanding at the close of business on the last working day of the second preceding month.