How To Register A Public Limited Company?

Registering a Public Limited Company is quick, easy, and can be done online with Legalguard.in 3 simple steps.

We help you obtain digital signature certificate.

We draft and file the documents required for registration (MoA, AoA & Declarations).

We help you with the post-registration formalities and compliances.

Public Limited Company Registration in India An Overview

YOU CAN NOW REGISTER A PUBLIC LIMITED COMPANY IN INDIA AT JUST RS. 17,499 (ALL INCLUSIVE)*

Setting a Public Limited Company is one of the recommended ways to start a business in India if you require large funds. Only a public limited company can get listed on Stock Exchange and do IPO & FPO and issue shares to the public at large. This type of company offers limited liability for its shareholders. Where a private limited company can be registered with 2 directors and shareholders, 3 directors & 7 shareholders are required to register a public limited company.

Legalguard.in, your leading legal consultant, offers quick Company Registration service in India at nominal pricing. Here you will find how you can register your company.

We take care of all legal formalities and fulfil the compliances, as defined by the Ministry of Corporate Affairs. Post-approval of the company registration, you receive a Certificate of Incorporation (CoI), along with PAN and TAN. Thereafter, you can open a current bank account and begin your business operations.

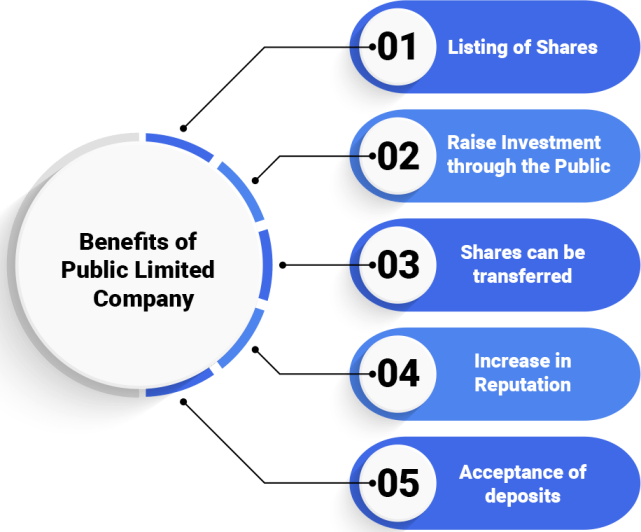

Why Choose Company Registration?

Registering a company offers many benefits. A registered company increases the authenticity of your business. It helps your business -

The most obvious advantage of being a public limited company is the ability to raise share capital, particularly where the company is listed on a recognised exchange.

Since it can sell its shares to the public and anyone is able to invest their money, the capital that can be raised is typically much larger than a private limited company.

It’s also possible that having stock listed on an exchange could attract investment from hedge funds, mutual funds and other institutional traders.

Offering shares to the public gives the opportunity to spread the risk of company ownership among a large number of shareholders. This may allow early investors in the company to sell some of their own shares at a profit while still retaining a substantial stake in the company.

Obtaining capital from a wide range of investors has some advantages over-relying on one or two “angel investors”, as many private companies will choose to do to facilitate growth. While an angel investor may provide a large amount of capital and expertise, the founders may not be comfortable with the level of influence over the company’s direction that the angel will often expect.

As well as share capital, a public limited company will often find itself in a better position when looking at other potential sources of finance.

The demands of being a public limited company and maintaining a stock exchange listing, for example, can help to improve a company’s creditworthiness when issuing corporate debt (and therefore reduces the return the company needs to offer investors).

Banks and other financial institutions may be more willing to extend finance to a public limited company, particularly one that is listed. The company could also be in a better position to negotiate favourable interest rates and repayment terms on loans.

The value of being able to raise finance is in how it can be employed to serve the business. By having more finance potentially more readily available and on better terms than a private company, the public limited company can be in an advantaged position to:

- Pursue new projects, new products or new markets

- Make capital expenditure to support and enhance the business

- Make acquisitions (whether in cash or by offering shares to the shareholders of the target business)

- Fund research and development

- Pay off existing debt (or replace existing debt with new debt on better terms)

- Grow organically

Again, these factors can affect the behaviour of (potential) shareholders, customers and business partners.

The shares of a public limited company are more easily transferable than those in the private equivalent, meaning shareholders benefit from liquidity. If shares are quoted on a stock exchange, shareholders and potential shareholders will generally find it easier to transfer shares in the company – although the market still relies on willing purchasers and sellers being available.

The fact the shareholders are less bound to remain with the company can give them comfort – and may help the company by making people more willing to invest.

Without restrictions on transferability of shares that often apply in private companies, it’s also easier to deal with situations like a shareholder’s death, allowing shares to be transmitted in line with the terms of any will.

Going public can enhance the options for the founders to exit the business at some point in the future, if they wish to do so. Both higher transferability of shares and the increased visibility of the business and its performance may increase the chances of bid interest from potential suitors.

Whether deserved or not, having ‘plc’ at the end of a company name can add standing and prestige. There is a sense of status about a public limited company that its private company counterpart just doesn’t quite have, which can affect how the business is viewed. While often more imagined than real, this perception of being more established, larger or more powerful can affect the behaviour of customers, suppliers and employees.

More people are likely to be aware of the company if it is public, particularly if it’s listed on a stock exchange. In that case, it’s more likely to receive attention from the media and investment professionals. This is effectively free publicity, meaning more people will recognise the company and its products or services. Better brand recognition can lead to more sales. It may also make you more visible to valuable potential business partners.

Operating under a stricter legal regime than private companies in many areas Higher share capital requirements Greater transparency (for example, in the required form of accounts) For listed companies, the indirect endorsement of having their shares listed on a recognised exchange.

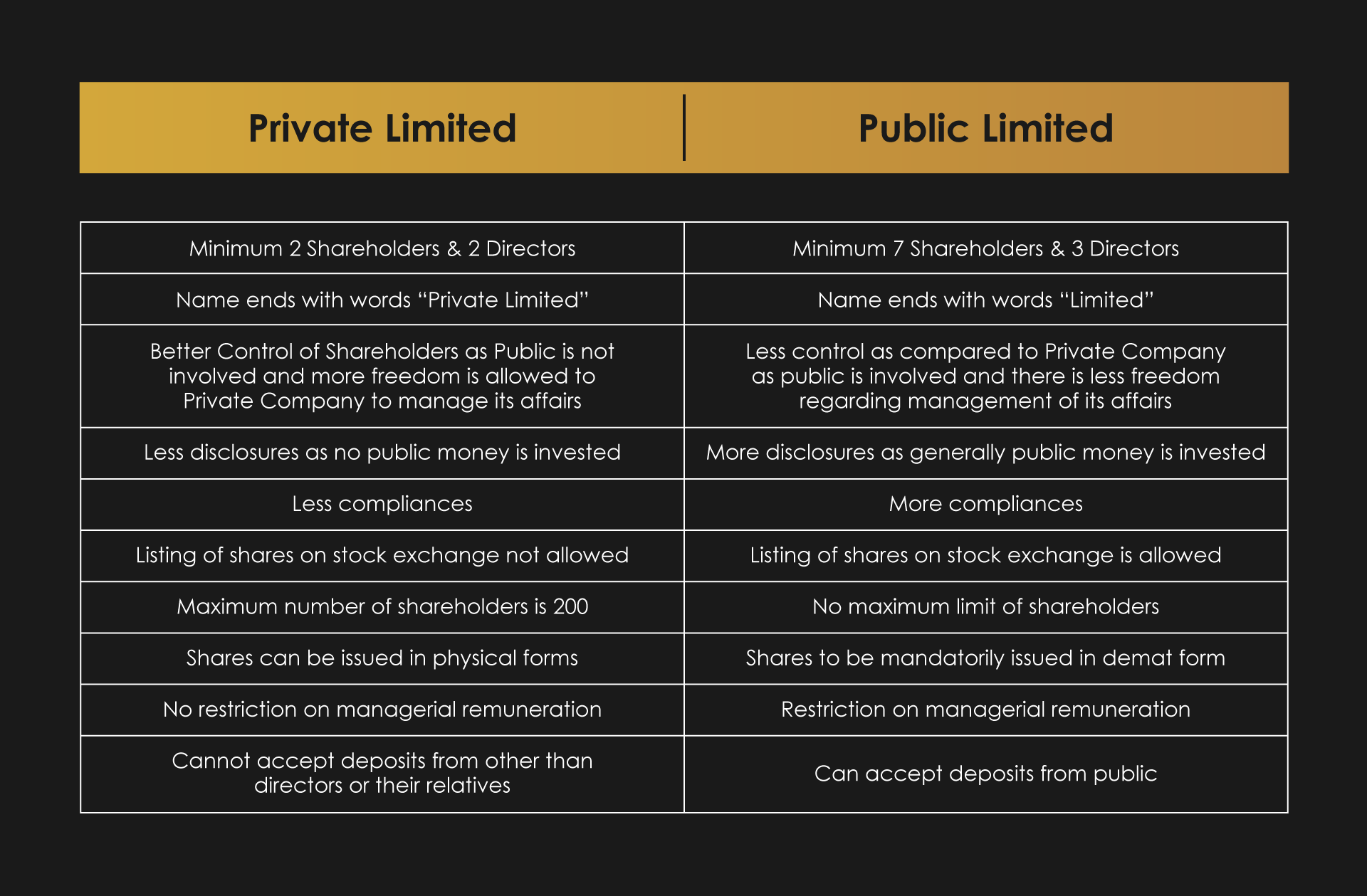

Differences between Public Limited and Private Limited Company

Minimum number

At least seven persons must be there to form a public limited company. Two persons will be enough to form a private limited company.

Maximum number

There is no limit to the maximum number of shareholders in public limited company. A maximum number of shareholders is limited to fifty in a private limited company excluding the past and present employees of the company.

Issue of prospectus

A public limited company can invite the public to subscribe for its shares. It must issue a prospectus or file a statement in lieu of prospectus before issuing shares. As per law, a private limited company has no rights to invite the public and as such cannot issue prospectus. They cannot get the public to subscribe for its share capital

Transfer of shares

Transfer of shares can be done easily in a public limited company. The rights of members to transfer their shares is restricted the Articles of Association in a private limited company.

No.of directors

There should be at least three directors for in the management of a public limited company. At least two directors are required for a private limited company.

Retirement of directors

Not less than two-thirds of the directors must retire on every annual general meeting from the management by rotation in a public limited company. Though the retiring directors can be and are generally reappointed at the same annual general meeting. There is no compulsory retirement in a private limited company.

Name of the company

A public limited company has to add the word ‘Limited’ at the end of its name. A private limited company has to add the words ‘Private Limited’ at the end of its name.

Directors remuneration

There are certain restrictions on the payment of remuneration to Directors in a Public limited company. There is no such restriction in a Private limited company.

Demat account

A public company can only issue shares in Demat mode and have to get ISIN for its shares immediately on its registration. A private company can issue shares in physical form and do not need to take ISIN for its shares.

Checklist for Registering a Company in India

Checklist for Registering a Company in India

As defined under the Companies Act 2013, we have to ensure the requirements of the following checklist

A public limited company must have at least three directors and at most, there can be 15 directors. Among all the directors in the company, at least one must be a resident of India.

The name of your business must be unique. The suggested name should not match with any existing companies or trademarks in India.

There is no minimum capital amount for a company. A company can be registered even with a capital of Rs. 1,000/-

The registered office of a company does not have to be a commercial space. Even a rented home can be the registered office.

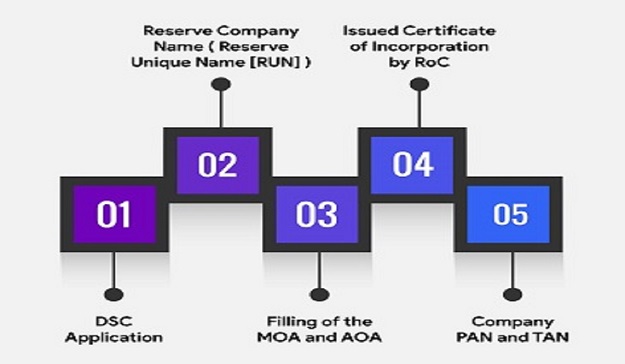

How to Register Company Online - A detailed registration process

Company Registration in India will boost the progress of startups and provide an additional edge over those who have not registered. The Ministry of Corporate Affairs governs the company registration process with rules and regulations framed following the law.

- Step 1: Application for DSC (Digital Signature Certificate).

- Step 2: Application for the name availability.

- Step 3: Filing of the eMoa and eAoA to register a public limited company along with ESI-PF, PAN & TAN application

- Step 4: Issued certificate of incorporation by RoC with PAN and TAN

Search a company before Company Registration

One of the primary steps in Company Registration is to ensure that the company name has not already been taken by another legal entity. We can run a company name search to check the availability of the particular name in India against the MCA and trademark database.

The Company name can be checked in MCA Database

@ http://www.mca.gov.in/mcafoportal/showCheckCompanyName.do

and in Trademarks Database

@ https://ipindiaonline.gov.in/tmrpublicsearch/frmmain.aspx

We recommend the businesses to come up with three to four alternative names. The Ministry of Corporate Affairs will be the final authority to approve the name based on the availability rules and regulations.

If you are disappointed that a preferred name is taken, do remember that the name of your company doesn't have to be your brand name.

Documents required for Online Company Registration

In India, Private Limited company registration cannot be done without proper identity and address proof. These documents will be needed for all the directors and the shareholders of the company to be incorporated. Listed below are the documents that are accepted by MCA for the online company registration process.

- Scanned copy of PAN Card. Foreign nationals must provide a valid passport.

- Scanned copy of Voter’s ID/Passport/Driver’s License/Adhar

- Scanned copy of the latest bank statement/telephone or mobile bill/electricity or gas bill

- Latest Passport size Color photograph of all the promoters (Shareholders and Directors)

For foreign nationals, an apostilled or notarized copy of the passport has to be submitted mandatorily. All documents submitted should be valid. The residence proof documents like the bank statement or the electricity bill must be less than 2 months old.

- Latest & Clear Telephone Bill/Electricity Bill/ /Water/Gas Bill of the registered office address

- No Objection Certificate from the owner(s) of the premises of the registered office.

Note: Your registered office need not be a commercial space; it can be your residence too.

What you get after Company registration

Legalguard.in Company Registration Package Includes:

Why Legalguard.in

Access To Experts

We provide access to reliable professionals and coordinate with them to fulfil all your legal requirements. You can also track the progress on our online platform, at all times.

Realistic Expectations

By handling all the paperwork, we ensure a seamless interactive process with the government. We provide clarity on the incorporation process to set realistic expectations.

150-Strong Team

With a team of over 150 experienced business advisors and legal professionals, you are just a phone call away from the best in legal services.

Frequently Asked Questions

Do I need to be physically present during this process?

No, new company registration is a fully online process. As all documents are filed electronically, you would not need to be physically present at all. You would need to send us scanned copies of all the required documents & forms.

How much time is needed for setting up a public limited company in India?

We can register a Company as early as 4 days. The time also depends on the relevant documents provided by the applicant and the speed of approvals from the government. To ensure speedy registration, kindly pick a unique name as the proposed Company name and also ensure that you have all the required documents prior to the starting of the registration process.

What are the rules for picking a name for a public limited company?

There are very comprehensive rules for Company names. Basically, the first word should be a noun, followed by the word depicting the business of Company (not necessary but advisable), followed by the words Limited.

What is a DSC?

DSC i.e. digital signature certificate is required to electronically sign the documents required to be filed for registration of a Company. It is made by submitting identity documents with a certifying authority and downloaded in a token like a pen drive.

What are articles of association and memorandum of association?

These documents contain the rules, vision and mission of your organisation, and define, among other things, the exact business and the roles and responsibilities of shareholders and directors.

Are 3 directors & 7 shareholders necessary for a Public Limited Company Registration?

Yes, a minimum of three directors and seven shareholders is needed for a public limited company. There is no limit of numbers of directors and shareholders in a public limited company.

Can Directors & Shareholders be the same persons?

Yes. Directors & Shareholders can be the same persons in a Public Limited Company but a minimum of 3 directors and 7 shareholders are required to register a Public Limited Company. 3 persons may have directorship as well as shareholding while others may have only the shareholding.

Can the director of a public limited company also be a salaried person?

Yes, a salaried person can become the director in a private limited, public limited, LLP or OPC private limited company. One needs to check the employment agreement if that allows for such provisions. In a lot of cases, the employers are quite comfortable with the fact that their employee is a director in another company.

Can one register a Public Limited company on their home address?

Yes, one can register the company at their residential address. One requires to submit the utility bill copy of the same.

Is it necessary that the utility bill being submitted as office addres proof should be in the name of director or shareholder?

No. The utility bill can be in the name of any person other then a director or shareholder.

If there are no partners available, then can one register their family members in the company?

Yes, it is a good to register a family member as a partner. At a later stage one can change this or transfer shares of the directors.

What is authorised capital and paid up capital?

The authorised capital is the maximum value of equity shares that can be issued by a company. Paid-up capital is the amount of shares issued by the company to shareholders. Authorised capital can be increased any time after incorporation to issue additional shares to the shareholders.

Can NRIs/Foreign Nationals become Director in a Private limited Company?

Yes, a NRIs and Foreign National can become Directors in a Private Limited Company. They can also be a majority shareholder in the company. Provided at least one Director on the Board of Directors should be an Indian Resident.

What are the mandatory post incorporation compliances for companies?

Can the address of directors & shareholders be different than registered office address of Company?

Yes. Even the state of directors & shareholders can be different from the state of the registered office address of the Company.

Can directors & shareholders be from different states?

Yes. They can be from different states. Even any of them can be a foreign citizen also.